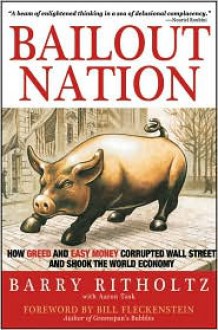

Bailout Nation: How Greed and Easy Money Corrupted Wall Street and Shook the World Economy

Do you find yourself wondering: How did we get here? How did the United States of America get into such a predicament whereby in one year, 2008, the financial system nearly vaporized, the stock market crashed, real estate tanked, and major corporations were being bailed out. . . .How did our...

show more

Do you find yourself wondering: How did we get here? How did the United States of America get into such a predicament whereby in one year, 2008, the financial system nearly vaporized, the stock market crashed, real estate tanked, and major corporations were being bailed out. . . .How did our great country, a bastion of capitalism, devolve into a Bailout Nation where the gains were privatized, but the losses were socialized?—From the Foreword by Bill FleckensteinIn Bailout Nation, Barry Ritholtz, author of the popular finance blog www.ritholtz.com/blog/, deftly mixes financial history with an insider's knowledge of modern finance to reveal how we've arrived at one of the worst economic crises ever. Engaging and informative, this book clearly shows how years of trying to control the economy with easy money has finally caught up with the United States and how the government's practice of repeatedly rescuing Wall Street—as well as other industries and organizations—has come back to bite them.Divided into five compelling parts, this timely guide opens with a brief history of bailouts, detailing their particular patterns and unintended consequences. From here, it quickly moves on to reveal the events, individuals, and institutions that have shaped our current situation. You'll see how various government interventions—in individual companies such as Lockheed during the 1970s, in specific sectors such as banking in the early 1990s, and eventually, entire markets with the rescue of stocks in 2000—opened up a Pandora's Box. You'll also discover how the misguided philosophies of many players, from Fed Chairmen and Presidents to Senators and Treasury Secretaries, promoted the massive meltdown that has engulfed our global economy.Ritholtz leaves no stone unturned, as he breaks down how the Federal Reserve's interest-rate targeting policies as well as a condition known as moral hazard—the belief that

show less

Format: Textbook

ISBN:

9780470520383 (0470520388)

ASIN: 9780470520383

Publish date: 26-05-2009

Publisher: Wiley, John & Sons, Incorporated

Pages no: 332

Edition language: English