This is why we'll be striking today, along with millions of others across the country and our globe. There is no planet B and we can still fix this.

This is why we'll be striking today, along with millions of others across the country and our globe. There is no planet B and we can still fix this.

Aditya Birla Sun Life Mutual Fund is known for providing some of the best mutual funds in the Indian market. The investor-centric approach has allowed it to win the trust of millions of investors over the years. Following are the top schemes which have been selected by the experts at MySIPonline after analysing every aspect of mutual funds.

Aditya Birla Sun Life Tax Relief 96 Fund

This should be your ultimate choice for tax deduction if you can take a slightly higher risk for long term investment. It is a prominent ELSS scheme which has a golden past of providing phenomenal returns to the investors. The fund allows tax deduction of up to Rs 46,800 every financial year and delivers high returns on the invested amount through an aggressive equity portfolio. Potential investors must note that the fund possesses high risk and must be chosen for the long term.

Aditya Birla Sun Life Equity Fund

It is a multi-cap scheme which is largely chosen and appreciated by the investors due to its consistency. The fund manager invests in the most adequate type of equity instruments from the range of top 500 stocks on the stock exchange. The opportunity for growth can be grabbed from any segment of the equity market. It has an impressive past and can be an ideal choice for the investors who seek a diversified portfolio for consistent capital gains.

Aditya Birla Sun Life Frontline Equity Fund

It is a largely chosen large-cap scheme which invests in equity instruments of prominent companies in India. The fund is known for providing consistent gains in the long term and has been trusted by a large number of investors. The AUM is more than Rs 21,500 crore. It is ideal for investors who seek a pure equity scheme with low risk for a tenure of 3 years or more.

Aditya Birla Sun Life Regular Savings Fund

This is a conservative hybrid scheme which is also known as a debt-oriented hybrid scheme. The fund invests nearly 70% of the corpus in the fixed income securities and the rest in equity instruments to deliver reasonable gains at low risk. It is ideal for those who are not satisfied with the returns of pure debt scheme but cannot invest in an equity-oriented scheme.

Aditya Birla Sun Life Banking & Financial Services Fund

It is a sectoral fund which predominantly uses the equity instruments of financial companies. As the sector has always done well in the Indian market and the government is focused to add more strength to the sector, this scheme can deliver impressive gains to the investors. It is ideal for the experienced investors who can make better decisions regarding investments as the risk is high but the rewards are higher.

Aditya Birla Sun Life Mutual Fund is a top player in the mutual fund industry and has provided some of the best performing mutual funds in India. There is a large number of top-performing schemes available to invest. Investors should choose the most suitable scheme from a wide variety of available mutual funds which can help oneself to achieve the financial objective. To know more about the schemes or to check the suitability, connect with the financial experts at MySIPonline.

Buying a house is never an easy task. With the housing prices increasing at a great pace, it will be a dream to buy houses of our own in the near future. Although, with the availability of modern investment tools, financial planning to buy a house can be done conveniently if the investment is done in a disciplined manner. Mirae Asset Emerging Bluechip Fund can be an ideal choice for such financial objectives as the fund aims to deliver long term capital appreciation to the investors. The experts at MySIPonline recommend investing through SIP in Mirae Asset Emerging Bluechip Fund to achieve the target in 10 years.

What is Mirae Asset Emerging Bluechip Fund?

It is a top performing mutual fund in India which has excelled in every aspect of comparison with the peers. It falls under the category of large and mid-cap mutual fund and holds the respect of being one of the best in the category. It has delivered consistent gains to the investors for a long time under changing market conditions. The fund manager Mr Neelesh Surana is highly experienced to grab every money-making opportunity in the large and mid-cap segment. Mirae Asset Emerging Bluechip Fund has delivered the highest returns to the investors in the category and is also one of the most rewarding mutual funds in India.

To Buy a House in 10 Years

Buying property after 10 years can be a challenging task. Considering the growth rate in the cost of construction, a well-furnished flat of 2 BHK or more can be worth more than 2 crores after 10 years. To achieve such a gigantic financial target, investors need to plan in advance. Using the SIP calculator at MySIPonline, we can calculate the amount that needs to be invested monthly in Mirae Asset Emerging Bluechip Fund. The fund has maintained more than 20% trailing returns since inception and the trailing returns for the last 5 years are also more than 20% hence for next 10 years, we can expect the fund to deliver returns of anywhere between 16 to 20%. To buy a decent house or flat at a good location one needs to invest Rs 50,000-70,000 every month for 10 years. Investments should be done in a disciplined manner regardless of the market conditions.

Can Anyone Invest?

Investors need to understand that Mirae Asset Emerging Bluechip Fund is an equity scheme and the investments are done in various equity instruments. The performance of the fund entirely depends upon the stocks selected by the fund manager. He invests an equal proportion of corpus in large and mid-cap stocks. The fund involves high risk due to major involvement of aggressive stocks. Investors must be ready to face frequent fluctuations in the short term as the market trends are highly responsible for the performance of the scheme. The stocks selected by the fund manager can be highly productive in the long term.

Mirae Asset Emerging Bluechip Fund is a top-performing mutual fund in India and can be chosen for long term capital gains. It can be a great choice if the investment tenure of more than 5 years. The fund has a superior track record and can be an optimum choice for buying a house after 10 years. To make a personalised investment plan for free of cost, connect with the financial experts at MySIPonline.

If you are among the mass that expects minimal risk from pure equity mutual fund, then ICICI Prudential Bluechip Fund is what you are looking for. This large-cap fund invests only in the best of equities in India and is considered as the safest equity schemes as almost every stock present in the portfolio possess a ‘bluechip’ quality which makes the portfolio more promising and less risky for the investors. The experts at MySIPonline recommend the scheme to a number of conservative equity investors seeking long term capital gains. Read till the end to find out the reasons which make it an optimum choice for low-risk equity investments.

ICICI Prudential Bluechip Fund; Know Before Investing

This bluechip fund follows the mandate of a large-cap fund and was launched in 2006 by ICICI Prudential Mutual Fund with an aim to deliver long term gains to the investors from the stocks of leaders of Indian economy. The fund has strategically utilised every positive opportunity in the equity market to deliver better gains than peers while the negative returns have always been limited above the benchmark and category average. Following are reasons which makes it an optimum choice for conservative equity investors.

ICICI Prudential Bluechip Fund has provided best returns in the category in the long term while maintaining low risk in the short term. This unique ability of the scheme has been successful to attract millions of investors. It is an ideal choice for the investors with low-risk appetite seeking pure equity mutual fund for long term capital gains. To start investing today or to know more about the scheme, connect with the financial experts at MySIPonline.

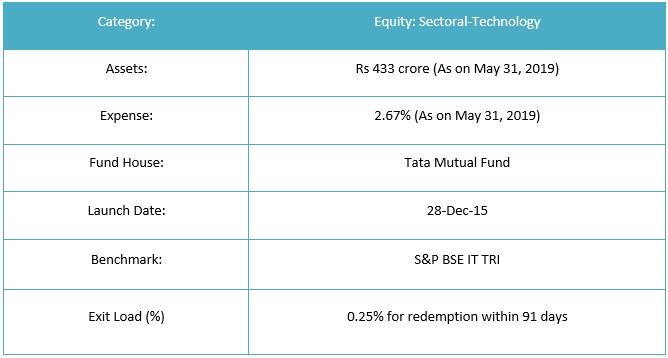

In the last few years, the technology sector has witnessed tremendous market conditions as the concerned stocks have been constantly achieving new heights. Tata Digital India Fund is currently one of the best sectoral scheme in India as the technology sector has been contributing a lot to the Indian economy in the last few years. It was the most productive mutual fund for the calendar year of 2018 and the YTD returns for 2019 are also at impressive levels. Despite impressive stats, experts at MySIPonline recommend the scheme only to a limited audience. Is Tata Digital India Fund suitable for you?

What is Tata Digital India Fund?

Tata Digital India Fund is without a doubt one of the best sectoral schemes in India that invests in the stocks of IT companies. The returns have been mostly ranked among the best in the category. Despite coming later in the market, it has earned the respect of being a top-notch performer. The fund managers Ms Meeta Shetty and Mr Sailesh Jain invest nearly 50% of the corpus is invested in TCS and Infosys. 10-12 stocks are included in the portfolio and growth style of investment is followed.

Why is IT Sector Successful in India?

The IT sector has witnessed a rapid growth in recent years which is expected to stretch for a long term in future. The key reason for the exponential growth of IT sector in India is the increasing number of engineers ready to work at lower wages. India is the largest exporter of IT products and the majority of the revenue in the sector comes in foreign currency. Hence, the weakness and strengthening of Rupee also play a vital role in the performance of IT stocks in India. TCS and Infosys are the leaders in the industry while a lot of emerging IT companies are growing rapidly.

Is it Suitable For You?

The performance stats of Tata Digital India Fund might look impressive and the sector also has a great scope in the future. However, all the stocks in the portfolio are from the IT sector and any slump in the sector might pull every stock prices resulting in steep fall in the NAV of Tata Digital India Fund. The fund has a focused portfolio and only has 10-12 stocks which are not enough to diversify the portfolio of the scheme. In simple words, the fund possesses a high risk and can deliver a sudden rise or fall in returns. To take the optimum advantage of the scheme, the investor needs to keep a close eye on the performance of the IT sector in the economy along with probable outcomes in the future. Hence, the fund is ideal for experienced investors who can make informed calls and can take high risk in mutual fund investments.

Tata Digital India Fund is one of the best mutual funds in India but certainly not suitable for every kind of investors. Investment in mutual funds must be done according to the investment objective and risk appetite of the investors. The fund must not be chosen for short term trading as it can show exponential fluctuations. Investors must take the assistance of financial experts at MySIPonline before investing who can also guide throughout the investment process.