24 Market Reports has recently announced the addition of a new report on the Automotive Composite Materials: Emphasis on Material Type, Manufacturing Process - Insights and Forecast, 2018-2024 Market Research Report. The study is aimed at presenting in-depth insights into the factors encouraging and inhibiting the market’s growth between 2016 and 2024. The report is titled “Automotive Composite Materials: Emphasis on Material Type, Manufacturing Process - Insights and Forecast, 2018-2024” and is available for sale on the company website.

In the past few decades the automotive industry has grown exponentially, witnessing several technological advancements among vehicles. A supporting aspect of this is the increase in GDP of several countries that led to an increase in per capita income, which in effect strengthened the buying potential of consumers worldwide. High affordability for the consumers increased the demand of vehicles with enhanced luxury, comfort, and safety of the vehicle. Owing to this, the number of vehicles has been continuously increasing since 2009, which is evident from the fact that the number of vehicle production in 2017 increased to 97.31 million as compared to 94.64 million in 2016.

In addition, the increasing number of the vehicles has increased the content of greenhouse gases (GHG) in the atmosphere. In the same context, using composite materials is considered to be one of the best methods to reduce the GHG emissions, as they are light in weight, thereby helping improve fuel efficiency. Besides being a lighter substitute to steel and aluminum, composite materials have higher strength and durability. Owing to such factors, there is an impending inclination towards the lightweight vehicles among the automakers.

Some of the other major reasons fueling the adoption of composite materials in the automotive industry are stringent government regulations on GHG emissions, increasing usage of composites, among hybrid and electric vehicles and better structural and mechanical properties of composites than steel and aluminum. Concerned with the alarming level of GHGs in the atmosphere, governmental bodies such as National Highway Traffic Safety and Administration (NHTSA) of the U.S., Environment Protection Agency (EPA), European Commission (EC) and Ministry of Environment and Protection of China, among several others issued regulations mandating the reduction in emission of Carbon Dioxide (CO2) and other greenhouse gases by vehicles.

To motivate the automakers for composite materials, governmental bodies are offering certain subsidies and relaxation in taxes as well. Besides this, the composite materials are now widely adopted in electric and hybrid vehicles to offset the weight increased by the addition of the batteries. Further the better structural and mechanical properties of the composites such as high tensile strength, resistance to corrosion and moisture, high temperature withstand capabilities, and better crashworthiness capabilities than steel and aluminum are also attributed to be the major factors for their widespread adoption. Owing to this, the global automotive composite materials market is expected to reach US$ 8,173.4 million in 2024 from US$ 4, 297.0 million in 2017 at a CAGR of 9.7% during the forecast period (2018-2024).

The factors that are hampering the market growth are the high cost of the raw materials and manufacturing and the lack of innovations in the developing countries. However, the growing advancements in the hybrid composites, increasing partnerships, merger and acquisitions and potential in the emerging markets can be key opportunity areas for the composite materials manufacturers and automotive OEMs in the coming future. Polymer Matrix Composite (PMC), Metal Matrix Composite (MMC), Ceramic Matrix Composite (CMC) and Hybrid Composite are different types of the composite materials widely used across the automotive industry. Currently, PMCs are the most popular composite type among the automakers, as they have high flexibility, high insulation, lower density and lighter weight than other composite material types. Owing to such factors, the polymer matrix composites held the highest market value of US$ 3,259.7 million in 2017 and are anticipated to reach to US$ 6,160 million by 2024 at a CAGR of 9.6% during the forecast period (2018-2024). In addition to this, the high cost and long cycle time of the composites have given birth to hybrid composites. Hybrid composite materials have better mechanical properties than single fiber composites; hence hybrid composites embody high growth opportunities and are expected to grow at the fastest pace of 12.4% CAGR during the forecast period (2018-2024).

The properties of the composite materials change with the manufacturing techniques. Some of the popular manufacturing processes include Hand Lay Up, Compression Moulding, Injection Moulding, and Resin Transfer Moulding (RTM). Injection Moulding dominated the market in 2017 with a market value of US$ 177.5 million and is anticipated to reach US$ 3,763.4 million by 2024 at a CAGR of 9.7% during the forecast period (2018-2024). On the other hand RTM will be the fastest growing manufacturing process because of its growing adoption in the auto industry. RTM is widely used for mass production of large and complex surfaces as it completely satisfies the low cost- high volume requirement of the automotive industry. RTM held US$ 355.60 million market value in 2017 and is expected to reach US$ 732.75 million at a CAGR of 11.0% during the forecast period.

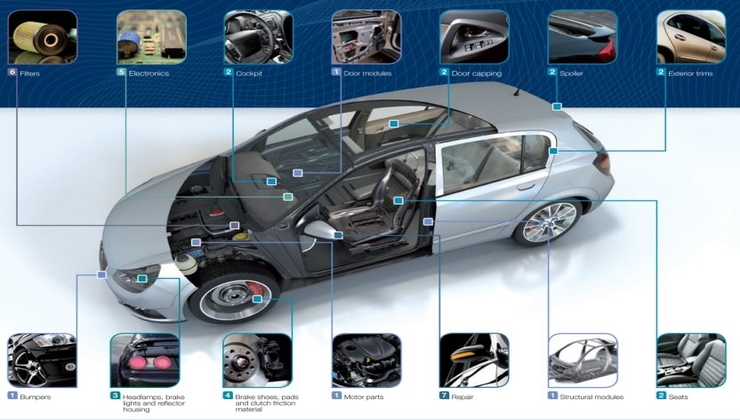

A visible surge in the usage of composite in almost all the areas of vehicle is witnessed. Composite materials are replacing steel, aluminum and other components in vehicle interiors, exteriors, structures, chassis and powertrain, among others. Among different application areas, exterior application dominated the market in 2017 with a market value of US$ 2,919.4 million in 2017 and is anticipated to reach US$ 5,496.6 million by 2024 at a CAGR of 9.6% during the forecast period. However, the stringent regulations on vehicle interior air quality are expected fuel the demand of composite demand for vehicle interiors. Owing to which, global interior application market is anticipated to reach US$ 626.9 million by 2024 from US$ 309.0 million in 2017, growing at the fastest growing CAGR of 10.8% during the forecast period (2018-2024).

Composite materials are widely used across all the vehicle types such as super cars, passenger cars and commercial vehicles. Among several vehicle types, passenger car segment held the highest market share with a market value of US$ 4,221.0 million in 2017 and is anticipated to reach US$ 7,865.3 million by 2024 at a CAGR of 9.4%. The highest market value of passenger cars among the vehicle segment is attributed to the growing adoption of composites for the light vehicles.

Further, across different geographies, Asia Pacific dominated the market in 2017 and is expected to remain dominant during the forecast period. The presence of several material suppliers, automotive OEMs, stringent emission regulations and increasing adoption of composites with parallel growing EV market, especially in China, among several other factors, were attributed to the highest market share of Asia Pacific in 2017. Asia Pacific was valued at US$ 2,163.2 million in 2017 and is anticipated to grow to US$ 4,103.6 million by 2024 at a CAGR of 9.7% during the forecast period.

Some of the major key players in the automotive composite materials market include BASF, DowDupont, Gurit Holding AG, Magna International Inc., Mitsubishi Chemicals Holding Corporation, Owens Corning, SGL Group, Solvay S.A., Teijin Limited and Toray Industries Inc. These players are entering into several strategies partnerships, merger-acquisitions, joint-venture, product launch, business expansion among others to strengthen their position in the automotive composite materials market.

CONTACT US:

276 5th Avenue, New York , NY 10001,United States

International: (+1) 646 781 7170

Fax: (+1) 212 634 4885

Email: help@24marketreports.com

Follow Us On linkedin :- https://www.linkedin.com/company/24-market-reports

Log in with Facebook

Log in with Facebook