Instalment loans are widely popular because you can manage your payments easily. However, this facility is available in case of long-term loans. A long-term loan is a loan paid back over a period of more than 12 months. Bad credit loans are short-term loans. The aim of these loans is to help you tide over during emergency or unforeseen expenses.

A bad credit loan is a funding source that aims at helping those people who have impaired credit standing. With the poor credit rating, it is onerous to borrow money from traditional lenders, but online lenders have made it possible. All you need to do is fill out the application form and if you qualify for it, you will get money the same day directly in your account. Your income statement serves the basis for the approval of your application.

Bad credit loans come with higher interest rates because the lender is sceptical about your payment capacity. The repayment length of these loans cannot be more than a year depending on the amount you borrow and the policy of your lender. Among all short-term loans, loans for people with bad credit are featured with instalment payments. Is it true or a stratagem to trap gullible borrowers?

Some require lump sum payment

Each lender follows a different policy. If you research, you will find some will be offering these loans with instalment payments and some will be offering with lump-sum payments. It is crucial that you know the policy of the lender beforehand so that you do not get nasty surprises down the line.

The disbursal limit for poor credit loans varies from lender to lender. If you are borrowing a small amount, for instance, not more than £1,000, you will end up paying the whole of the money in a lump sum. Lenders do not allow you to retain money for beyond a month.

However, some lenders will allow you to pay back in either weekly or bi-weekly instalments, settling your whole debt within a month. If you want to pay down monthly, the size of the loan needs to be as large as possible.

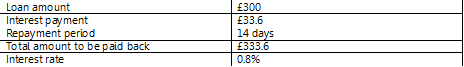

However, these instalments including weekly or bi-weekly do not include the amount of your principal. Understand this by an example:

Case 1: A lump-sum payment

You will pay off £333.6 as the period of two weeks expires. If you fail to pay back the debt, you will have to roll over the loan for another two-week period.

Case 2: weekly instalments

The payment will be as follows:

![]()

At the end of week 2, you will pay the principal amount (£300) in a lump sum. It means that your every instalment will go toward the interest-only, but you will pay the principal at the end of the term in a lump sum.

Amortisation

If you want to pay down the debt in equal monthly instalments including the principal amount, you need to make sure that the loan is amortised. It includes periodic payments made to both the principal and the interest.

If the size of your borrowing is small, you cannot get this facility. A few direct lenders provide amortised instalment loans for bad credit. You should ask the lender about it before signing the agreement.

Such loans come with two payment methods:

- 1- Equal principal payments

- 2- Equal total payments

Most of the lenders follow the second payment method because you know how much amount you will have to pay every month beforehand.

The bottom line

If you want to take out instalment loans for bad credit, you need to ensure whether the lender follows the policy of amortisation or not. Do extensive research before choosing any lender. Interest rates and APR may vary. Make sure that you borrow money from a lender who lends money at affordable interest rates.

Log in with Facebook

Log in with Facebook