You can save hundreds -- or even thousands -- of dollars by employing some of these tips. In the process you may end up better prepared for retirement, too.

A major tax bill has been passed, and in the years ahead many Americans will be paying more than before, while many others will pay less. Folks in both camps will still want to minimize any sums they pay Uncle Sam, so here are some tax tips to help many taxpayers shrink their bills.

Note that many of these actions can be taken throughout the year, not just at the end of the year or come April. For best tax-minimizing results, think about and tend to your taxes all year long.

Tip No. 1: Learn about changes to the tax laws

Few people are eager to read up on taxes, but the new legislation ushers in so many changes that it's worth becoming familiar with many of them, in order to best plan. For example, many tax deductions are ending in 2018. These include:

Personal exemptions. These allowed many taxpayers to shrink their taxable income by a hefty $4,050 per person in 2017. This is gone for the 2018 tax year, though an increase in the standard deduction will partially offset it.

Moving expenses. Some job-related expenses (such as license and regulatory fees and unreimbursed continuing education).

Parking and transit reimbursement. Companies have been allowed to subsidize worker transportation costs up to $255 per month per worker, with the sum deductible by the employer and not counted as income to the worker. With this deduction gone, the job benefit may disappear, too.

The tax brackets themselves have changed, for 2018, with new tax rates and new income levels qualifying for them.

Tip No. 2: Contribute to retirement accounts

One tax benefit that hasn't changed, fortunately, is our ability to use tax-advantaged accounts such as IRAs and 401(k) s to save for retirement. There are two main kinds of IRA -- the Roth IRA and the traditional IRA, with the latter shrinking your current taxable income and giving you an upfront tax break, and the former offering tax-free withdrawals in retirement. For 2017 and 2018 alike, the contribution limit for both kinds of IRAs is $5,500 for most people and $6,500 for those 50 and older. Meanwhile, a 401(k) (which also exists in traditional and Roth forms) has much more generous contribution limits -- for 2017 its $18,000 for most people and $24,000 for those 50 or older, and for 2018 it rises to $18,500 for most people, while the $6,000 catch-up limit is unchanged.

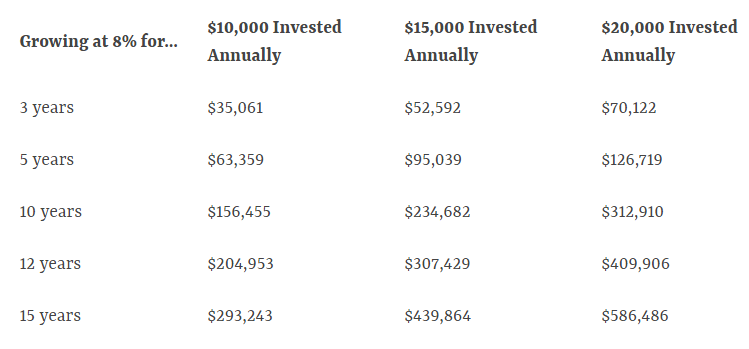

Those allowable investments are quite powerful if your money can grow for many years. The table below shows what you might accumulate over various periods if your investments average 8% average annual growth:

Tip No. 3: Consider your holding periods

Don't sell any stocks without giving some thought to how long you've held them. Don't base your decision solely on taxes, but know that as of now, most of us face long-term capital gains tax rates (for qualifying assets that were held at least a year and a day) of 15%. Short-term capital gains face your ordinary income tax rate, which could be close to twice as high. So if you've held a stock you want to sell for 11 months, consider hanging on for another month and a day.

Tip No. 4: Use your losses to offset gains

You can make lemonade from lemons when you have an investment loss: If you know you'll be facing taxes on capital gains you realized throughout the year, such as via stocks sold at a profit, you may be able to reduce or wipe out the taxes owed on that by offsetting the gains with losses. For example, if you have $8,000 in gains and you sell enough holdings to generate a loss of $6,000, you can pay taxes on only $2,000 in gains.

If you have way more losses than gains, you can wipe out your gains entirely, then shrink your taxable income with up to $3,000 of your losses, and then carry over any leftover losses into the next year. (If you plan to buy back any of the losers you sold, be sure to wait at least 31 days, lest you end up with a "wash sale" that doesn't count.) Keep this strategy in mind throughout the year, as there may be particularly good times to sell various holdings for a gain or loss.

Tip No. 5: Open a Health Savings Account (HSA)

If you have a qualifying high-deductible health insurance plan, you may be able to take advantage of an HSA. You fund an HSA with pre-tax money, lowering your tax bill just as you would with a contribution to a traditional IRA or 401(k). That money can be used tax-free for qualifying healthcare expenses. The money in the account can accumulate over years, too, invested and growing. Once you turn 65, you can withdraw money from an HSA for any purpose, paying ordinary income tax rates on withdrawals. Thus, an HSA is actually a bit of a healthcare expense/retirement hybrid.

Tip No. 6: Use a Flexible Spending Account (FSA)

This is another account that accepts pre-tax dollars and lets you spend them tax-free on healthcare expenses. It's not quite as wonderful as an HSA, though, as you need to use most of your contribution each year, or you lose it. Still, if you plan well, this can save you a lot in taxes. For 2018, the FSA contribution limit is $2,650. If you're in the 24% tax bracket and sock away that much, spending it on eligible expenses, you can avoid paying $636 in taxes.

Tip No. 7: Take your Required Minimum Distribution (RMD)

Fail to start taking your RMDs once you hit age 70 1/2 can be costly, resulting in penalties. Some retirement accounts such as traditional IRAs and 401(k)s require them, expecting you to withdraw certain amounts each year. The deadline to take your distribution each year is Dec. 30, except for the year in which you turn 70 1/2. For that year, you have until April 1 of the following year to take your RMD. (It can be better to take it before the end of December regardless, though, lest you end up taxed on two distributions in one year.) See if your account can be set up so that your RMD is sent it to you automatically each year.

Tip No. 8: Keep track of your spending and receipts

Don't wait until April to start scrounging around for whatever receipts you can find. Make your life easier by having a "taxes" folder or shoebox open all year round, into which you can drop any receipts or other documents that will support your tax return. For example, you should keep receipts from your charitable giving and medical spending to support possible deductions. Track your spending, too. If you find that you're spending a lot on healthcare, which might mean you'll be able to itemize your deductions.

Tip No. 9: Get help

Finally, don't let tax matters overwhelm you. There's no shame in hiring someone to help with your tax strategizing and tax-return preparation. In fact, a good tax pro will know far more about the tax code than you do and may be able to lower your tax bill while suggesting effective strategies. Don't just hire anyone, though. Ask around for recommendations. Consider hiring an "Enrolled Agent," a tax pro licensed by the IRS who is authorized to represent you before the IRS if need be. You might find one through the National Association of Enrolled Agents website.

By employing some or all of the tips above, you can strengthen your financial condition and perhaps save hundreds or thousands of dollars. Why pay more in taxes than you have to?

Log in with Facebook

Log in with Facebook